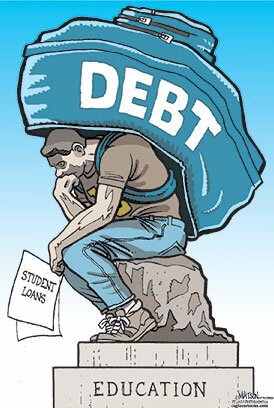

There’s no question about it: the current student debt build up is currently one of the most prevalent financial crises in America. But unlike credit or mortgage bankruptcy, the immediate effects of this economic monster are projected to hit a lot closer to home for us Millennials.

How close?

With total outstanding loans topping the $1 trillion mark in 2011, I’d say pretty damn close.

Via: doctorhousingbubble.com

In a recent study conducted by Wells Fargo, one third of post-grad participants claimed that, if they could reverse the clock, they would nix their four years of undergrad altogether and plunge straight into the workforce. Debt rates are so vast amongst GenerationY-ers that many are forced to weigh the worth of a college education in a job-sparse era against the indefinite possibility of owing the government more than a couple fist-fulls of dough for, oh let’s say, the next twenty years. And even if some schmucks are lucky enough to secure full time employment after turning their tassel, that multi-thousand dollar debt will prove to be one annoying roommate while house hunting. Do not pass go. Do not collect $200,000.

Amidst a topic that is undoubtedly a little morbid, there is some good news for the Gator Nation. UF has a stellar educational value amongst other universities nationwide, especially with the aid of our frugal friends Bright Futures and Florida Pre-Paid. Nearly ninety-six percent of the current, freshman class entered will full Bright Futures scholarships, proving that the University of Florida is still top dog when it comes to picking out the state’s masterminds.

However, as scholarship requirements grow increasingly harder to meet and cover less and less tuition costs, the debt crisis isn’t exactly something to brush off our shoulders. According to Project on Student Debt, the average debt of UF graduates in 2011 hovered at nearly $17,000 and thirty nine percent of the graduating class accrued some level of financial obligation to their alma mater.

Via: saltmoney.org

Although efforts such as Obama’s Income-based Repayment initiative have been made to alleviate the harsh blow of short-term loan payments, they’ve done little to address some long-term payback issues. The current loan forgiveness plan aims to create a need-based payment program with individual, financial capabilities of borrowers first in mind. Through another effort, the Federal Public Service Loan Forgiveness Program, grads who undertake non-profit or government employment have an upper hand in reducing both their educational debt costs and allotted payback time. By exchanging job commitment for reduced interest rates and principal write offs, they might taste sweet financial freedom soon rather than later. However, this plan creates yet another obligation for the American taxpayer and doesn’t exactly benefit those looking to go into a privatized work force. In a way, this plan is less of a solution than it is a hindrance in the debt-ridden individual’s capability in selecting a profitable career path. Essentially, the government aims to reward those who serve public interest while pushing others deeper into a sinking quicksand of unpaid student loans. A win-win? I think not.

If you’re like me, this crisis is not exactly haunting your dreams. Heck, every couple of months, I still get a crisp, clean check in the mail straight from the wonderful people of UF Financial Aid as a reward for solid grades and academic consistency. However, as more and more students strive toward higher degrees in fields such as medicine, law, and other graduate programs, this nice little pat on the back will become less frequent. While Bright Futures does pay for a semester of many post-grad studies, when you’re looking at three years at Levin Law, tuition digits will undoubtedly increase, giving you a swift kick in your penny-pinching pants.

You may have missed the boat in making carefully calculated economic decisions in regards to undergrad, but there are a variety of tools currently available in your quest toward mounting that shiny, gold MBA plaque on your office wall. By using this handy, loan calculator you can easily view stats on the time it will take to pay back your loans and manipulate your interest rates by doing so. Consumer Finance gives step-by-step, visual aid in everything from researching cost efficient graduate programs to managing your money and repaying assumed debt. Utilize the many features that the Internet has to offer. Do your research and pan for the future in order to avoid falling victim to a monetary point of no return.

As UF students, we have pretty much lucked out. We enjoy the social and athletic perks of attending big university while reaping the educational perks of an academically acclaimed establishment, all on an appealing dime. However, student debt is prevalent amidst even the most budget-friendly school and awareness and prevention are keys in avoiding the largest national debt in recent national history. When you’re looking at the big picture of your higher achievement and career, make sure your journey is paved in gold, not financial obligation.

Photo courtesy of: Salon